Blog Archives

Post navigation

The Business Value of Sustainability

While scientists issue warnings about a fragile climate, executives are embracing the business value of sustainability.

In quick succession in October 2018, the Nobel Prize in economics was co-awarded to a Yale professor who pegged the cost of poor environmental practices to economic health, and a United Nations (UN) panel of scientists revealed that the world has less than a decade to take action against devastating climate change.

Sustainability is once again front-page news.

And while governments struggle toward collaborative solutions, businesses are driving corporate sustainability efforts backed by big data analytics and location intelligence.

The UN’s Sustainable Development Goals

On September 25, 2015, heads of state gathered at the United Nations headquarters in New York City. At that summit, 193 countries signed on to a new set of global sustainability targets. The UN’s Sustainable Development Goals (SDGs) use simple language to lay out an international regulatory framework for radical changes to be made in the world by the year 2030.

The SDGs are known as a government initiative, but companies worldwide consulted on their development, and they will have a potentially enormous impact on the business world. In part, that’s because their successful implementation will require investment and support from the private sector. A report by the UN’s Sustainable Development Solutions Network estimates the cost of SDGs at US$1.4 trillion per year until 2030. The same report notes that approximately half of the investments can be privately financed.

The sustainability effort is of particular interest to companies that convert natural resources into products—among them energy providers, car manufacturers, and food purveyors. For those businesses, investment in the SDGs can be critical to conserving the raw materials of production for decades to come—and locking in long-term competitive advantage.

Across the business world, executives can see the implication: sustainability could soon become a major business opportunity.

The Role of the Private Sector

Just one day after the September 2015 summit, then-UN secretary-general Ban Ki-moon held the United Nations Private Sector Forum to discuss the role of businesses in achieving the Sustainable Development Goals. More than 200 executives from organisations around the world joined him in New York, including leaders from Dell, Deloitte, Facebook, Fidelity, PepsiCo, and Siemens AG.

The secretary-general told business leaders, “I am counting on the private sector to drive success. Now is the time to mobilise the global business community as never before. . . Trillions of dollars in public and private funds are to be redirected towards the SDGs, creating huge opportunities for responsible companies to deliver solutions.”

Corporate organisations seem to agree. In a 2017 McKinsey survey, nearly 60 percent of organisations said they are more engaged with sustainability than they were two years prior, with engagement levels rising to 80 percent in certain industries like packaged goods and infrastructure.

Indeed, as climate change continues, companies that rely on natural resources are taking a hard look at the long-term viability of their products. In some regions of the world, for example, water supplies might soon run out. Reliable cropland could turn fallow as temperatures and weather systems shift. And yet, just 21 percent of business executives told McKinsey that business growth was a top driver of their sustainability initiatives. One way to read that finding: a select few industry leaders have figured out that smart, sustainable practices sow the seeds of long-term growth and competitive advantage.

Innovative companies are adopting tools such as artificial intelligence, IoT, and analytics to address these challenges in ways that also benefit the business—doing well by doing good. In fact, according to the McKinsey report, nearly half of the organisations using technology to advance sustainability are employing big data and advanced analytics, which typically includes location intelligence.

Where Sustainability Meets Opportunity

One such company is Nespresso. An autonomously managed subsidiary of Nestlé Group, Nespresso is known globally for its premium single-serving coffees. Key to Nespresso’s success and customer loyalty is the company’s emphasis on—and investment in—the consistency of its coffee’s flavour.

However, coffee is a delicate crop, frequently grown in developing countries and highly dependent on healthy ecosystems. This leaves coffee and Nespresso susceptible to the increasingly volatile effects of sociocultural events and climate change. For Nespresso, acting today to avoid the perils of tomorrow is not just good citizenship; it’s sustainable business.

“Sustainability is really at the core of our business. It is an imperative to our long-term business success,” explains Yann De Pietro, operations and sustainability technology manager for coffee at Nespresso. “There have been studies saying that by 2050, Arabica coffee may not be available anymore in some countries if we don’t do anything now.”

The company is working to combat that decline so that the seeds of Nespresso’s competitive advantage remain fertile long into the future.

Leading companies are discovering compelling links between corporate citizenship and profitable business.

Controlling Challenges through Sustainability

Nespresso has made a deliberate choice to integrate these challenges into its decision-making process and act on them through sustainability programs. These programs help convert liabilities into business opportunities while supporting the farmers and communities that grow coffee.

Nespresso works with over 100,000 farmers in 13 countries, up from 300 farmers 15 years ago. (See the sidebar for more.) In 2003, the company launched its responsible coffee sourcing program, the Nespresso AAA Sustainability Quality Program, in partnership with the Rainforest Alliance. The program is designed on two convictions: that high-quality coffee and the sustainability of farming communities are interconnected, and that only by building trusting, long-standing relationships with coffee producers can Nespresso hope to make a positive difference.

The company supports the implementation of sustainable agricultural practices at farms by investing in technical assistance, paying premiums directly to coffee farmers, and co-financing infrastructure improvements.

Communicating with Customers through Maps

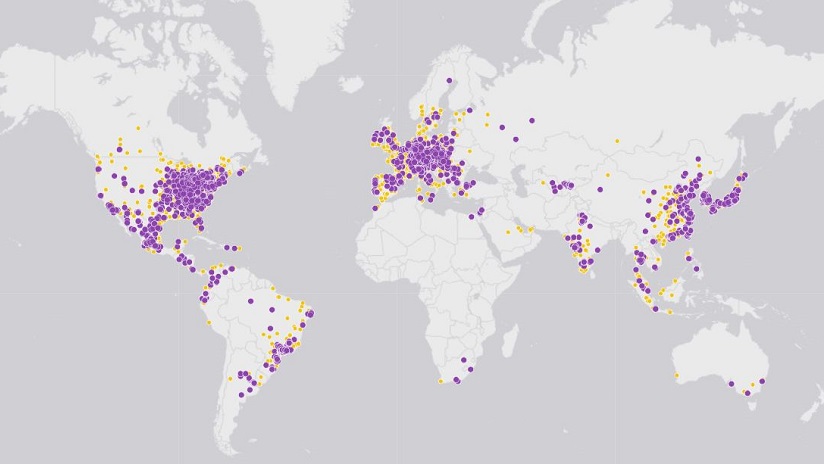

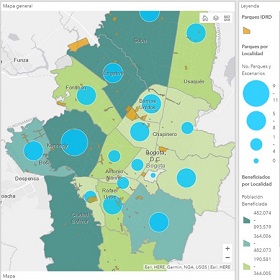

Nespresso communicates its sustainability work to customers with the help of location intelligence technology. “When we need to explain something to [customers], a map is much more relevant than a report,” says Nespresso’s Yann De Pietro. The company’s sustainability dashboard features information such as the location of Nespresso-supported farms, farmers’ profiles, and the dates when farms were last visited by a Nespresso agronomist.

“We can always say we work with 100,000 farmers in the world, but if people don’t see it, they won’t believe it,” De Pietro says. “That’s the big win that we have with GIS. It’s sharing, communicating, and making people understand.”

As part of that effort, the company has invested in a network of over 450 agronomists—specialists who provide coffee growers with on-site technical assistance and trainings on practices such as pruning, crop renovation, fair treatment of workers, water usage, and biodiversity conservation, all of which can earn farmers industry certifications.

Through the AAA program, Nespresso invests approximately US$35 million per year in technical assistance and premiums paid to farmers for their quality coffee. The educational program is free to farmers and doesn’t require them to sell to Nespresso, De Pietro explains. But the benefits to each side help create long-lasting relationships and loyalty.

Nespresso has a publicly stated goal of sourcing 100 percent of its “permanent range” coffee—the brand’s most prominent line of coffee capsules—from AAA farmers by the year 2020. In 2017, the company bought approximately 90 percent of its beans from those farmers.

The AAA Sustainability Quality Program falls under Nespresso’s broader strategic framework, The Positive Cup, which focuses on four areas: coffee, aluminium, climate change and engagement. In addition to its goal of sourcing all coffee from AAA growers by 2020, Nespresso has committed to other milestones that include sourcing 100 percent of its aluminium from responsible, ASI-certified sources, offering consumers convenient solutions for recycling, reducing the carbon footprint of each cup, and reaching carbon neutrality for its operations.

In 2016, the company tied those efforts to the UN’s Sustainable Development Goals, committing to making an impact on 11 of the 17 SDGs. In addition to Climate Change and Water Stewardship (which contribute to SDGs 13 and 6, respectively), Nespresso called out Responsible Consumption and Production (supporting SDG 12) and Decent Work and Growth (for SDG 8) as foundational to consumer goods organisations such as itself.

Today Nespresso is using GIS and location intelligence to build a comprehensive view of farming operations and accessibility across regions. “We have started to have a global vision of accessibility of the farms,” De Pietro says.

Progress through Digital Transformation

While its sustainability program has been in effect for years, Nespresso has seen recent rapid results due to advances in digital technology.

“Digital transformation is a key change for sustainability” at Nespresso, De Pietro says. “[We] want to provide maximum impact. So we need the tools to help us to maximise our efforts.”

On the balance sheet, the results look promising. When Nestlé announced its 2017 results, it singled out Nespresso’s mid single-digit growth worldwide and mid-teens growth in North America. The parent company’s growth was led by coffee, pet care, and health-science products.

At the centre of Nespresso’s digital transformation is location intelligence. The company has built a robust monitoring and evaluation system using advanced digital technology that records, maps, and shares data about farms, farmers, and coffee crops. This reveals local feedback and insight on AAA’s impact, as well as the status of each farm, including its objectives, achievements, and performance. The digital platform—which is powered by a geographic information system (GIS) and data analytics—also reveals insights into the way farmers deliver coffee beans to central mills to be harvested, a key factor in supply chain productivity and efficiency.

Bringing Intelligence to Location Data

One of De Pietro’s goals is to help farmers get their crop to market more efficiently. A recent analysis in Colombia exemplifies how location intelligence can create business advantage for the company and its partners.

A location analysis revealed that farmers brought their crops to certain Colombian mills—many of them close to their farms—less frequently than projected. De Pietro queried the GIS technology to dig deeper into the data so that he could understand these behavioural patterns. What he discovered was a reminder of topography’s effect on time to market.

With basic maps, he says, the team could work out the distance between farmers and mills. But only with sophisticated location intelligence could they understand the true travel distances to each central mill. Applying a similar analysis to the agronomists who visit Nespresso’s AAA farms, De Pietro and the team found a similar pattern. The analysis uncovered areas where the terrain required long rides or walks through the mountains to reach certain farms, making frequent visits impractical. For a company that works with 100,000 farmers, having a digital engine to deliver that kind of intelligence is crucial.

In both cases, location intelligence pointed the way to better business and sustainability practices. If the mills were more centrally located, farmers could get coffee to market more quickly. And when the agronomists can reach the farms faster, they can hasten the day when 100 percent of Nespresso’s coffee is sourced from sustainable farmers.

A Dashboard View of Sustainability

Sustainability can often be measured through the effects that company operations have on local and global systems. Leading business executives are turning to sustainability-focused dashboards to discover the intelligence they need to track operations.

The insight that appears on a dashboard depends on the company’s industry and the executive’s responsibilities. A retail CXO might monitor fluctuations in carbon emissions throughout the supply chain. A manufacturing executive might track water consumption at processing plants around the world.

Just as retailers and logistics companies use location intelligence technology to plot out the most efficient drive times for customers or delivery personnel, Nespresso embraces the realisation that the distance to a location is less important than the amount of time it takes a customer or farmer to get there.

Today Nespresso is using GIS and location intelligence to build a comprehensive view of farming operations and accessibility across regions. “We have started to have a global vision of accessibility of the farms,” De Pietro says.

As Nespresso makes progress in Colombia and around the world, the organisation maps its efforts back to the UN’s Sustainable Development Goals as a way to organise and guide strategic decision-making. The AAA program, for instance, directly impacts SDG 8 (through inclusive growth), SDG 2 (by promoting sustainable agriculture), SDG 4 (through learning opportunities for all), SDG 1 (through efforts to eradicate poverty), and SDG 6 (by way of water stewardship).

The Future of Sustainability

The use of location intelligence to shed light on the granular details of day-to-day coffee farming sets Nespresso apart. By examining and adjusting locations for farmers, the company frees up precious time and increases productivity. This impacts not only farming, but also time for education and strategic planning—the very activities Nespresso hopes will sustain its coffee crops far into the future.

But questions remain on how to effectively implement wide-scale change across industries. The global community faces major challenges on this front in the coming decades. The Sustainable Development Goals, for example, are not on track to be realised by 2030. The UN acknowledges where countries are lagging behind, stating, “This ambitious agenda necessitates profound change that goes beyond business as usual.”

Business-as-usual attitudes are among sustainability’s challenges. Some of the largest and wealthiest organisations in the world are not actively participating in sustainability efforts. The UN’s SDG Commitment Report 100, released in 2017, found that American companies score far worse than their European counterparts. Of the 18 companies with no mention of sustainable development themes, 15 are American.

Regardless, there are strong incentives to invest in corporate sustainability strategies, for reasons both reactive and proactive.

For instance, a team at McKinsey found that up to 70 percent of an organisation’s earnings can be impacted by risk-related sustainability issues. Michele Giddens, a specialist in sustainable and impact investing, sees businesses beginning to accept and support a shift to a circular economy where optimising sustainability can increase long-term growth.

Nespresso’s example spotlights the reality defined by these scenarios. Its core product and the heart of its brand—coffee—is at risk from climate changes in coming years. The company is approaching these challenges proactively, taking steps to not only mitigate risk, but also use digital technology and location intelligence to create strategic differentiators.

Treating sustainability as both a guiding principle and an opportunity to gain competitive value may be the way forward for other innovators in the business community.

Burgers for a Penny, and the Power of Location Intelligence

Burger King heats up the burger wars with a marketing campaign aimed at its chief rival, and executives everywhere take note.

If you thought the burger wars had cooled off, take note. Through a combination of marketing moxie, mobile innovation, and location intelligence, one international brand has fired them up again.

The flare-up comes courtesy of Burger King, which recently launched a bold effort to poach customers from rival McDonald’s. Like all memorable marketing campaigns, this one is both simple and fiendishly inventive.

As reported by QSR magazine and other outlets, the gambit works like this: Anyone with the Burger King mobile app and location services enabled on a smartphone can order a Whopper for just a penny—as long as they do so within 600 feet of a McDonald’s location. The BK app then directs the customer toward the nearest Burger King to claim the meal.

The initiative ends December 12, but its impact is likely to be felt well beyond.

A Digital Fence and a Dream

The practice of geofencing is integral to the Burger King effort. The geofence relies on several components, including an IoT device in the form of a smartphone, real-time IoT communications, and basic location intelligence. When the app senses that a customer’s phone has crossed the digital “fence,” around a McDonald’s location, it unlocks the $.01 deal.

Geofencing is a form of location intelligence typically managed in a modern geographic information system (GIS). Companies inside and outside the retail industry have used the technique for customers connection, compliance, and even worker safety.

For instance, some logistics providers set up geofences to ensure that drivers stay within designated delivery routes. Oil and gas companies enlist GIS-powered geofences to deliver alerts to workers who are near hazardous areas. And organizations in many industries create geofences that trigger deals for shoppers, notifications for upcoming concerts, and information about historical landmarks.

Perhaps the most cunning use of location intelligence in the Whopper scenario isn’t the ability to sense where customers are, but the functionality that gets them where they need to be in time to retrieve their orders.

A Marketing Campaign Underscores Changing Customer Preferences

The BK marketing campaign may be short on subtlety, but there’s one aspect of it that may not be so obvious: Burger King is using location intelligence to answer an emerging customer demand that crosses industries.

The Whopper deal, it turns out, is a way to promote the new order-ahead capabilities in the company’s mobile app. Customers can now place orders through a mobile device and skip the line when they reach the restaurant. Delivering similar capabilities is front of mind for retailers, restaurant executives, and nearly all B2C companies. They’re answering it in interesting ways, with the help of location intelligence.

Logistics companies, for instance, are using GIS-fueled apps to deliver packages to almost any destination, subject only to the customer’s whim. Some will even deposit a package in a customer’s car trunk with help from a temporary access system that combines GIS and blockchain technology. (For more on that innovation, stay tuned for WhereNext’s article on holiday deliveries.)

One of the top beverage retailers in the world uses GIS in its mobile app to ensure that customers who place orders on their devices will find their orders ready—at the expected temperature—when they walk into the store.

As consumer preferences and expectations change, forward-leaning executives in many industries are disrupting traditional methods of customer interaction. Through a combination of marketing ingenuity and GIS-powered location intelligence, some are finding new ways to stand out from the competition.

(For examples of how leading companies have harnessed location intelligence, explore this e-book.)

Business Leaders Confess IoT Confusion

A recent survey reveals that business leaders believe strongly in the promise of IoT. Many simply don't understand it.

Tucked away in a recent Vodafone report on digital transformation is this unexpected finding: 41 percent of UK executives worry that IoT technology is too complicated for their business, and 36 percent don’t understand the Internet of Things.

The findings serve as a useful reminder that the lifespan of buzzwords can be shorter than the adoption curve of the technologies they describe.

While IoT remains relevant, marketing cycles have moved on to artificial intelligence, Geoblockchain, and other emerging trends. The tacit message is that IoT has already become a foundational business technology—and for some companies, it has. But as the Vodafone survey reveals, a significant number of businesses feel intimidated or left behind by the promise of IoT.

An Optimistic Thought

The Vodafone survey starts out cheerily enough. The telecom giant interviewed 2,000 companies in the United Kingdom and found that nearly two-thirds (64 percent) believe that IoT will better their operations. Sixty-seven percent are already using IoT technology or plan to within the next two years.

Respondents held roles in strategy or technology planning and hailed from a diverse group of companies, ranging from small businesses to large enterprises. Not surprisingly, large enterprises are more likely than their smaller cohorts to expect that IoT will transform their business operations.

The survey didn’t offer details on why 41 percent of business leaders feel hamstrung. But they could be paralyzed by the possibilities. When IoT is lauded for its ability to change everything, as it often is, some business executives might struggle to identify the one thing it should change first.

Starting with a Win

In a 2016 article in the MIT Sloan Management Review, a pair of Boston College professors offered guidance to executives unsure of where to begin with IoT. Start small, the professors advised. Identify a business question that has gone unanswered due to a lack of data, and consider whether IoT technology might deliver that data. They also advised exploring other options before deploying IoT technology. If a problem can’t be solved any other way, it might be a perfect pilot project for IoT.

In a 2017 WhereNext Think Tank, Esri’s Kevin Bolger discussed how businesses can get started with IoT. He offered the example of a food manufacturer that created an IoT pilot project for the supply chain:

We tend to think of the Internet of Things as a network of sensors, but you can also think of it as the bar code on [a] clamshell package that holds produce. That creates visibility not just of a shipment but down to an individual SKU. So IoT data can give a company fine-grain tracking and understanding of its assets. That also pays dividends when it comes to reverse logistics. If specific products need to be recalled, a company that knows the product’s origins down to the SKU level can perform more selective recalls and avoid waste.

The Thrill of Discovery

One characteristic of the most successful IoT projects is their use of location data. In the Think Tank discussion, Bolger noted how private companies—among them insurers and retailers—are getting smarter about using publicly available, location-specific IoT information.

For example, when Hurricane Harvey hit the Houston area, businesses used publicly available, real-time IoT data to understand where the storm was moving; what impact it was having on rivers and creeks; and how best to safeguard employees, customers, and facilities. In Bolger’s words:

We’ve got this ecosystem now of people, organizations, and businesses, both private and public, that are creating and sharing [IoT] information. Organizations are leveraging that across multiple business functions to provide the right services, the right decisions, and the right value.

Whether the IoT data comes from public sources or from a company’s own deployment, it often helps answer the questions that keep executives up at night. For the 41 percent of decision-makers who worry that IoT is too complicated for their business, the expert opinion seems to be this: start small, but start now.

How Do You Market a Hurricane-Resistant Floating Home?

Luxurious, self-powered, hurricane-resistant homes are selling for $5 million. Where do you find customers for that marketing pitch?

If economic history has taught us anything, it’s that innovation always fills an economic void. Today, a housing startup called Arkup is marketing a novel form of living to a populace increasingly mindful of climate change.

To create what it calls “livable yachts” meant to withstand category 4 hurricanes, Arkup has taken the concept of the houseboat and added luxury and resilience. Its self-propelled, waterborne homes offer more than 4,000 square feet of living space, run on solar power, and feature extendible stilts that can protect the home from turbulent seas, according to a recent Business Insider article.

Timing may work to the new company’s advantage. Some real estate and insurance experts believe the value of waterfront property could decline in the years ahead. In the past decade alone, the average premium that homebuyers are willing to pay for waterfront real estate has dropped from more than 50 percent to 36 percent, according to research by Zillow.

To answer the call of residents who value waterfront living but fear the consequences of a volatile climate, Arkup has partnered with a Miami yacht company to charter and sell its new floating homes.

Matching an Economic Need

A 2017 Yale survey found that 71 percent of Americans believe global warming is happening, and 22 percent say they’re “very worried” about it—more than twice the number who said so two years earlier.

That sounds like a sizable market for Arkup to address, but the company’s pool of prospective buyers is actually much more select, not least because its waterborne yacht costs $5 million. To market to those well-heeled buyers, Arkup and other companies marketing luxury sustainable goods need deep insight on where they live, work, and play.

Retailers, banks, prominent consumer brands, and other businesses have performed this kind of analysis for decades, often with the help of geographic information systems (GIS) technology. A GIS ties information to location, creating what’s known as location intelligence.

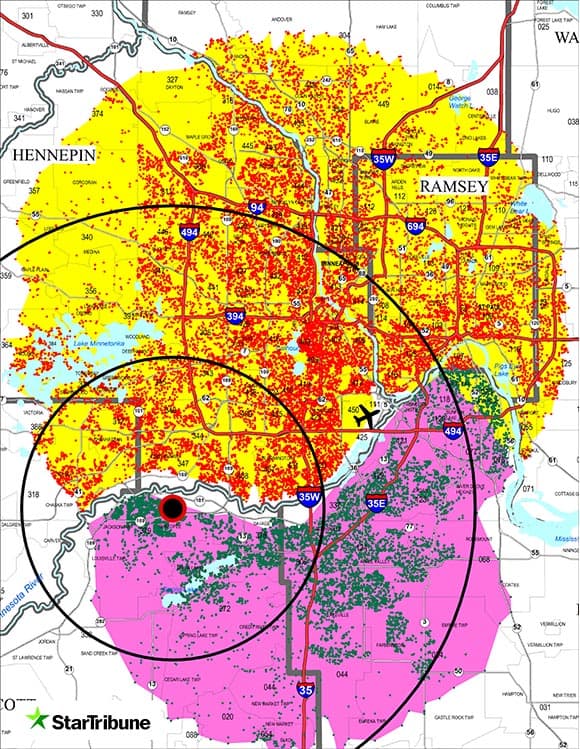

Location intelligence can be a valuable marketing tool for startups and established companies. Take Wayne Johansen, founder of HOM Furniture, who credits location intelligence with helping his company grow from a startup to the eighth largest regional furniture chain in the country.

Johansen discovered location intelligence with help from the marketing department at the Star Tribune, where HOM advertised. HOM was looking for particular types of buyers, and the newspaper’s GIS analysts found them by plotting demographic data on a map, revealing in startling detail traits such as income, age, family size, and lifestyle interests.

“We were in a fast-growth stage and we felt that we had a winning game plan,” Johansen told WhereNext. “But the execution became much more scientific and precise with [those] tools and analysis.”

To market to prospective customers ahead of the competition, companies will need more than ingenuity and disruption. They’ll need effective data and actionable location intelligence.

Finding Customers to Boost Growth

A recent survey by the University of Redlands found that 83 percent of industry-leading, location-savvy companies consider location intelligence a valuable tool for discovering customer insight. By comparison, only 26 percent of spatially immature companies share that view.

For companies with sustainability-focused products and services to sell—including floating homes built for wealthy buyers concerned about the effects of climate change—location intelligence can deliver valuable insight on the customers who will help their business grow.

How GM Maps and Manages Supply Chain Risk

General Motors enlists real-time location intelligence to monitor and manage risk in one of the world's most complex supply chains.

Everyone has trouble sleeping from time to time. But if you’re in charge of monitoring global supply chain risks for one of the world’s largest automakers, there’s a lot to keep you up at night. Just ask Paul Rossi, currently a member of the strategic risk management team at General Motors, and formerly the company’s supply chain risk management (SCRM) lead.

GM produces more than 10 million vehicles a year in over 100 countries, sourcing more than 100,000 unique parts from 5,500 supplier sites worldwide. Suffice to say, GM’s worldwide production operation is a well-oiled machine. But as with any automaker, so much can go wrong.

GM’s production is exposed to a broad range of disturbances—from political uprisings and weather events to labour disruptions and supply shortages. When problems arise, the faster the SCRM team can get information to GM’s global crisis managers, the quicker the company can resolve those problems before customers are affected.

To do that, Rossi relied on a geographic information system (GIS) that maps the interconnections among GM’s thousands of tier 1, tier 2, and tier 3 suppliers. When an event such as a factory fire or a storm occurs, the system enables the team to focus on a specific part and trace it from its source to its destination plant and vehicle program.

If it looks like a part shortage could threaten production, Rossi’s colleagues in crisis management can activate their contingency plans much sooner than was possible when they manually collected data about adverse events.

“The most important thing is being able to respond and recover quickly when disruptive events occur around the globe—events like earthquakes, factory fires. By the time you know about them, you’re already in recovery mode,” Rossi says. He and his colleagues investigated 700 events (and took action on one-third of those) in 2017, the first year the system was in place.

The Upfront Work

Mapping GM’s supply base into the GIS (see image below) required a substantial upfront effort as well as ongoing maintenance, especially when it came to the tier 2 and tier 3 suppliers. “We have all the location information and data for our tier 1 supply base—the suppliers that ship directly to GM,” Rossi says. It proved much more difficult to map the sub-tiers, the suppliers that ship to GM’s tier 1 suppliers and their suppliers.

“It took a big manual effort of us reaching out individually to our tier 1 suppliers. We set a new expectation by putting a process in place to receive this information from our suppliers during the sourcing process,” he says.

Some suppliers shield the identity of their supply base, he notes, making them reluctant to provide details. In those scenarios, the SCRM team works with the suppliers directly to make sure they’re doing everything they can to manage risk, and to establish a clear expectation of what their crisis reporting to GM should look like.

GM also partners with several companies to obtain data from news sources and providers of critical weather information. “We’ve been able to integrate data feeds directly into our GIS tool,” he says. “It has allowed us to get all relevant information in one spot and run reports quickly.”

In essence, the system listens to a wide variety of information sources around the world and generates alerts when adverse events crop up. For example, if a fire breaks out at a supplier plant and a local news station covers it, Rossi and team will hear about it in near real time.

Need for Speed

Key internal customer Bill Prince, one of GM’s supply chain crisis managers, can attest that the risk-notification system gives the automaker more response time. Last year, for example, a magnitude 7.1 earthquake in central Mexico caused hundreds of deaths and impacted many GM supplier operations in the area. Already coping with the aftermath of Hurricanes Irma and Harvey, the crisis response team was nevertheless able to move fast when it received email alerts and a detailed report about the earthquake.

Quickly convening a crisis room, the five-person team used GIS-based maps to identify suppliers within a 100-mile radius of the quake. From there, the process is straightforward. “We contact the suppliers to be sure they are healthy and safe. We try to see if they need help or resources if they are impacted,” Prince says. “Then we run our normal operation where we manage available parts, get the pipeline restored, and allocate between assembly plants.” In this case, GM regional resources—the “boots on the ground”—worked with approximately 20 affected suppliers.

“The tool gives us a lot more focus than we would have otherwise,” Prince says.

The location intelligence has dramatically increased event-detection speed and accuracy and also improved the efficiency of GM’s response, according to Rossi. As a result, the company’s insurance premiums have dropped.

The GIS also enables supplier footprint analysis at a granular level, so purchasing and sourcing teams can make better-informed decisions. GM uses the system to maintain a socially responsible supply chain by pinpointing politically charged regions and steering clear of conflict resources that promote fighting and human suffering.

Understanding the geographic locations of our suppliers is key to understanding how a disruptive event will impact our supply chain.

Paul Rossi, GM

Supply Chain Tremors Ahead

Location intelligence will be particularly valuable to companies like GM as the number of adverse weather events grows worldwide. Respondents to the World Economic Forum’s Global Risks Perception Survey 2018 foresee environmental risks growing in both likelihood and impact over a 10-year horizon. That’s not surprising, given that weather events in 2017 were volatile, featuring high-impact hurricanes and extreme temperatures.

Expecting the Unexpected at GM

A wide variety of threatening events are on GM’s radar:

- Factory fires and explosions (the most common occurrences)

- Floods

- Storms

- Strikes

- Terrorism

- Cyber attacks

- Civil unrest

- Forest fires

Natural disasters are not the only calamity on the minds of supply chain managers, of course. Data security, terrorism, and war also rate high on the worry spectrum, according to the SCM World 2017 Future of Supply Chain survey. As supply chain analyst Kevin O’Marah wrote in Forbes, managing supply chain risk used to be a matter of avoiding supplier disruptions, but now the scope is much broader.

These are anxious times, and every extra piece of insight brings businesses more power to avoid interruptions.

Business, Uninterrupted

For GM, understanding the geographic location of its supply network is essential to understanding how a particular incident will impact its supply chain, Rossi says. “Having an understanding of what vehicles could be impacted by an event—which part numbers, and specifically which plants—really helps us create an effective response.”

Before the rollout of the location intelligence system, the crisis-response process was very similar to what it is now, but it often took days or weeks to fully understand the impact on suppliers, parts, programs, and vehicles. “We had to spend a lot of time prioritizing and pulling data,” Rossi says.

DX in the Supply Chain

Digital transformation is changing the way companies make decisions and manage their supply chains. For more on its role, visit this e-book on digital transformation.

Now, the location intelligence delivered by GIS “has allowed us to avoid costs associated with disruptive events. Even an hour’s worth of downtime at one of our plants can impact deliveries to our dealers and the overall customer experience,” he says.

Routine business disruptions can be just as threatening as natural disasters. GM recently had a supplier that went into bankruptcy unexpectedly. That supplier shipped multiple part numbers to multiple plants, enlarging the potential scope of problems.

“We could very easily and quickly trace the material flow from that supplier to each of the plants that they supplied,” Rossi says. “That allowed us to identify specific suppliers that could make up the production from the bankrupt supplier, and put us in a position to recover.”

GM is among the innovative companies that view location intelligence as a key tool for decision support throughout the enterprise.

“Without the tool, that could have taken weeks,” Rossi says.

Balancing Decision Support and Data Overload

With a wealth of rich data in GIS, it is a continual balancing act for Rossi and his colleagues to equip crisis managers with information but not overload them.

A recent factory fire—the most common of all the adverse events that affect GM’s production—that occurred in Michigan is a good illustration of an event that did not rise to the level of crisis. “They had a legitimate fire. It was reported on the news,” Rossi recalls. But an employee quickly put out the fire, and the line was down for only about 45 minutes. “Everyone went back in and got back to work.” In the end, this incident did not warrant raising a red flag.

Ahead of the Weather

Location intelligence helps GM prepare even for the unforeseeable. A case in point is earthquake-prone Japan, where many of GM’s tier 2 and tier 3 suppliers source their semiconductors.

Such commodities get extra attention, Paul Rossi says, because GM can’t simply plug in different semiconductors if supply of the original is cut off. That means a higher degree of contingency planning. “It’s very expensive to tool up multiple suppliers. There are cost barriers to having alternate sources,” Rossi says. “Where we know we’re counting on one or two specific locations, we do extra investigation and set up mitigation plans” in advance.

When an event is worthy of the crisis management teams’ attention, the risk management team first filters the data down to the most actionable and relevant insight. They deliver a report with an overview of the event as well as high-level statistics, such as the number of GM plants and suppliers that could be affected and the part numbers involved. “It’s important for us to provide the data and frame it in a meaningful way, not just for leadership but for our crisis management teams,” Rossi notes.

Location intelligence also helps the team understand which parts are dual sourced or even triple sourced—vital insight during a crisis. Now, “we understand when we have an alternative supply for a particular part that may be in an impact zone. The tool helps us understand that quickly.”

The Road Ahead

Rossi believes the location intelligence system drives a market edge for GM. “Part of the reason we believe this tool gives us a competitive advantage is because we’re first to respond after events occur,” he says. “So we’re in a position to provide our products to our customer in the wake of an event sooner than our competitors would be able to.”

He also strongly believes that supply chain risk management can help whole industries. The more companies that do it, the better off they all are, he says. That’s true for suppliers as well as OEMs.

Few suppliers have a supply chain risk management program that’s monitoring the globe for adverse events. “So we’re actually monitoring their supply base for them,” Rossi says, “and if something occurs with one of their suppliers, our crisis management team will reach out to make them aware.”

At GM, put simply, effective supply chain risk management boils down to the ability to accelerate the discovery of events and the actions needed to mitigate them.

Location intelligence “puts us in a position to protect our customers,” Rossi says. “Being prepared to react and respond quickly—and also having the edge to be proactive when we’re able—allows us to protect the supply to our customers, both internally and externally.”

Rossi acknowledges that being armed with data cannot remove supply chain risks altogether. The next major earthquake could happen tomorrow and disrupt GM’s supply chain, he says. “We just need to position ourselves as best we can to deal with that. GIS allows us to deal with the unknown–puts us in a position to be prepared.”

Paul Rossi and the General Motors GIS family would like to acknowledge the contributions of their colleague Tali Kritzer to the success of the GM Supply Chain Visualization application described in this article. Tali passed away this year, and will be greatly missed by the team.

BP Shares Eight Lessons on Digital Transformation

An inside look at BP's digital transformation, with lessons on successfully deploying enterprise software.

Leaders of Fortune 500 companies believe digital transformation is the future of their business. According to Forbes Insights, half of senior executives worldwide, when asked about digital transformation, said that the next two years will be “critical for their organizations in order to make this transition and prepare for future opportunities.”

Here at BP, that means embracing new technologies, including digital, which will improve our ability to monitor, predict, and optimize our business. Ultimately, this digital transformation will enable BP to create more sustainable operations, better manage expenses, and uncover new products and services for customers around the world.

Enacting digital transformation on a global scale is a vast undertaking at BP, a company of more than 70,000 employees dedicated to oil and gas exploration, production, transportation, refining, and retail—with airline and shipping divisions and a growing presence in biofuels and wind energy. Along the way, we’ve learned several valuable lessons that we’ll share here.

At BP, digital transformation takes many forms. We’ll explore it through the lens of location intelligence, which is critical to our business. Location intelligence helps BP professionals track the location and condition of assets; understand in real time the events that shape the regions and neighbourhoods where we operate; and identify areas of customer need and business growth.

In short, location intelligence helps us make smart business decisions across the globe.

Becoming a digital energy company required us to overhaul our location intelligence capabilities, and central to that transition was modernizing our geographic information system (GIS) capabilities. The lessons we learned during that implementation—detailed throughout this article—are worth considering for any company that enlists enterprise software to support digital transformation.

Lesson 1: Embrace the enterprise platform

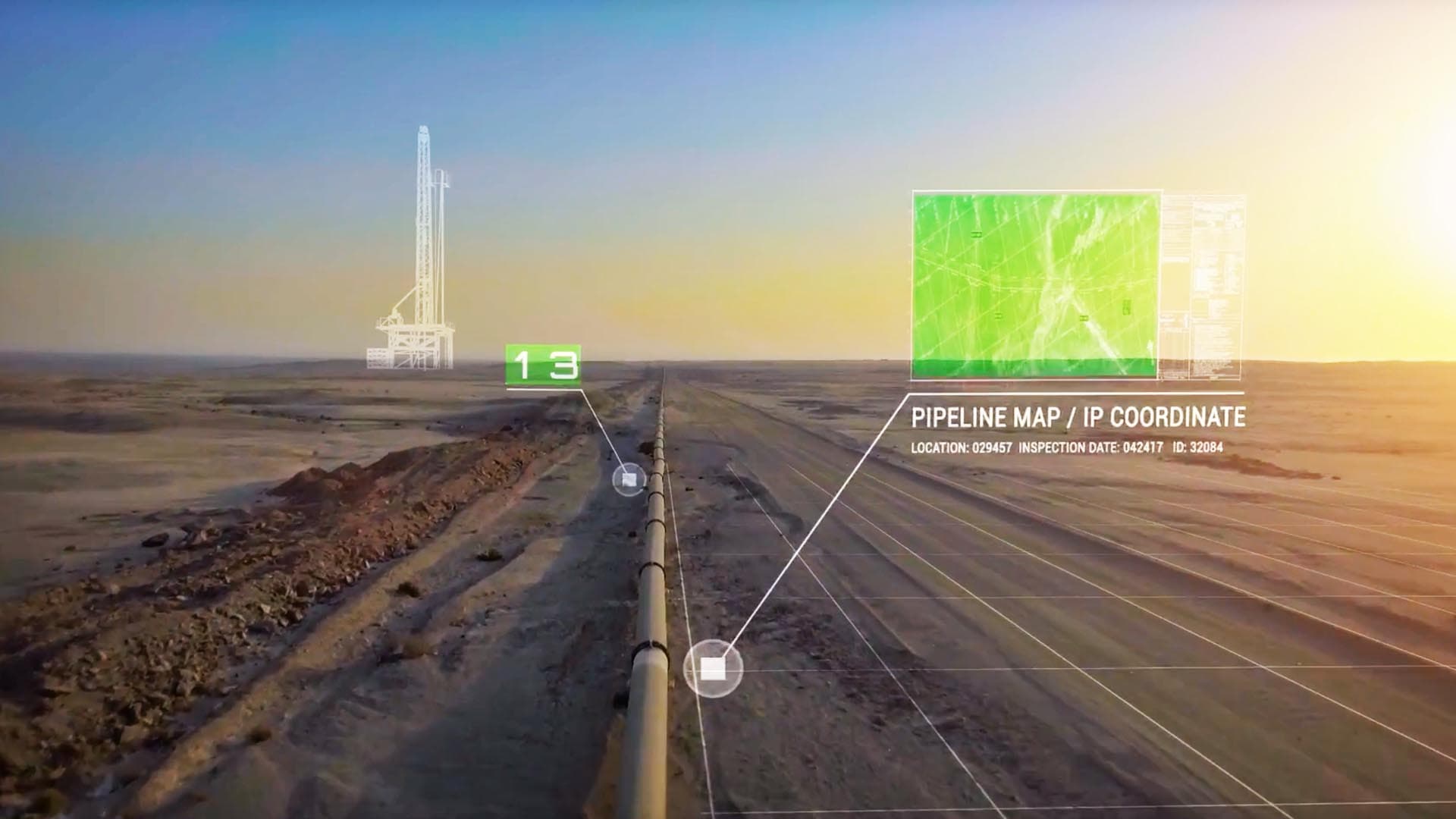

Location intelligence—and the GIS technology that underpins it—has long been crucial to BP’s business. Members of our exploration team use GIS-based maps to plot roads and design new access routes. Our environmental teams use GIS to create impact assessments, while our project teams leverage it to help design and deploy construction projects. GIS is the working geospatial brain that delivers the digital maps and analysis we need to help run a sustainable energy business.

The Fruits of Digital Transformation

For a look at how other companies are driving business advantage from digital transformation, visit this e-book.

As we set out two years ago to build a new foundation for location intelligence at BP, we systematically embraced an enterprise platform approach to GIS instead of building self-contained solutions for each business case. We wanted our experience with GIS to be similar to our experience with other enterprise technologies.

Over the years, numerous instances of GIS had taken root independently at BP. Businesses had various levels of GIS deployments, and some GIS tools had been built for specific workflows. But all were created at different times, by different teams, with different purposes, and we found ourselves with disconnected data and workflows. We had to support, maintain, and migrate multiple software versions almost constantly, and our total cost of ownership was excessively high.

Adopting a true platform approach has helped reduce those costs. But cost was just the beginning of the benefits. For BP and other companies, an enterprise platform pays dividends in numerous ways:

- The platform delivers faster time to value. BP professionals want decision-support tools that adapt to their changing needs. With an enterprise GIS platform, we can more easily build mapping and analytics apps at the speed of business—in fact, we enable business users themselves to configure lightweight apps rather than enduring longer software development cycles from a central team. By letting the users create the tools they need, a business can quickly convert data and information into insights.

- An enterprise platform speeds up collaboration. For illustration, we can look at BP’s pipeline team, which uses GIS as the system of record on the physical hardware of our pipelines, with details that include the equipment’s size, metal composition, age, and more. The pipeline team also manages conditional data꞉ the type of soil or water nearby, the pipeline’s maintenance history, and more. Others in Upstream also need access to portions of this information, and if those teams are working on separate systems, additional effort is required to export, translate, and load data from one system to the others, which can take hours or even days. When they’re on an enterprise GIS platform, those two teams can share the same location intelligence immediately, leading to quicker access, efficient analytics, and more informed decisions.

- The platform creates a virtuous cycle for geospatial information. We’ve seen many instances where a dataset that was considered basic information for one team turns out to be very valuable to another team. For instance, activities that we track in our Upstream business turned out to be very valuable intelligence to our Downstream teams. These two parts of the business may otherwise have had limited interaction. But with shared data on a common GIS mapping platform, users are now able to see the data resources available and use information from other teams. As a result, traditional organizational siloes have started to dissolve. That, in turn, has led to new efficiencies, insights, and business opportunities. We see this happening across teams and geographies.

In the enterprise platform, we give each business entity its own space to manage its data, workflows, analytics, and publishing. As a result, data and information are more accessible across the organization, leading to more opportunities to collaborate. This drives more value from each dataset and creates the virtuous cycle of new capabilities and opportunities that may have been missed.

For these reasons and more, we believe providing a company-wide geospatial platform—rather than building specific solutions—will lead to more sustainability and a larger return for an organization. The additional lessons below explain some of the learnings and best practices we have found while creating a successful and sustainable location intelligence system.

Lesson 2: When you’re everywhere, you’re nowhere

Location intelligence and GIS technology are leveraged across BP, and this diverse use creates a paradox that companies often experience with other enterprise technologies: because the technology is needed everywhere, it is owned nowhere.

Historically in many companies, the IT department—because it serves all the company’s businesses—has stepped in as the foster parent for enterprise software platforms. While this has been a successful model for enterprise tools with defined access and workflows, the model does not work as well for platforms with an open data structure and a nearly unlimited set of use cases.

BP’s Lessons on Digital Transformation

- Embrace the enterprise platform

- Find the right home

- Set your data free

- Let business users extend the platform

- Tailor user support to the new paradigm

- Automate

- Mind your marketing

- Measure success

An enterprise platform, by definition, is a tool that can be used in many ways. In the case of a geospatial platform, the use cases are especially diverse. At different times and for different parts of the business, the platform can act as a system of record, a system of engagement, and a system of insight. In light of this, we believe a location intelligence platform should be placed in the business function as close to the core business as possible, where they benefit from in-depth business knowledge, workflow understanding, geospatial data skills, and competence in the toolkit.

Regardless of where the platform is hosted, deep collaboration with the Information Technology and Systems (IT&S) organization is still crucial in delivering the technology platform. IT&S helps us deploy the right hardware, architect the most efficient system design, manage network and storage needs, and take care of the software portfolio.

As we implemented our location-based platform, we relied on a virtual geospatial project team composed of IT&S and business professionals to increase engagement, communication, and collaboration.

Deciding which part of the business organization should take ownership of the geospatial capabilities will be different for almost every company due to organizational structure, primary user groups, budgetary capabilities, and other concerns. For BP, the GIS platform found its initial home in the subsurface business under the Upstream segment.

Lesson 3: Set your data free

While the platform approach creates new opportunities by making data formats and services interoperable between our teams and functions, it also introduces new collaboration challenges.

BP has always had a mix of confidential data in our work. Historically, we have locked access to much of our data, either because of limitations in the technology or a “better safe than sorry” approach. Unfortunately, this resulted in duplication of data across projects and teams.

In the geospatial domain, this becomes a sizable issue. We found multiple files for the same pipeline locations, the same wells, etc. We also found subtle changes within some of the files. In many cases, the person who made the copy of the data moved on, and the team continued to use the information, assuming it was the most current version. This is not ideal in any digital transformation.

At BP, the reality is that 95 percent of the geospatial data we use can be shared across the entire organization; only a few key datasets need to be locked down. The solution was to challenge the status quo and open all data by default, allowing it to be available and shareable for multiple teams and diverse workflows. This helped power the virtuous cycle of use. Our advice to other executives is to lock down processes and data where required but leave the rest open to provide plenty of room for exploration and innovation. This is what drives new workflows, insights, and the greatest value from the enterprise platform.

That said, we needed to consider how to present data in the right way to help users of the open platform find the most appropriate information for their use case. This is an evolving effort. The solution for now is to tag “admin” items and encourage the use of metadata elements. Simple summaries and basic data quality metrics help ensure that users are more informed when making data choices. This leads to the next lesson: Let your users get their hands dirty.

You need to win user trust and acceptance quickly—don't just throw them an enterprise platform and say 'go.' Orient them first, because trust is easy to lose and exponentially harder to regain.

Brian Boulmay, BP

Lesson 4: Let business users extend the platform

Several years ago, when our GIS provider Esri predicted that our users would soon be able to create targeted apps for many of our location intelligence needs, I was sceptical. At that time, the thought of an end user being able to create apps seemed impossible, but now this is exactly what we see happening. This evolution is enabling almost anyone to build apps and workflows faster than we could produce in a central team, and this is making our business smarter and faster than ever.

Through today’s digital software platforms, app development is lightweight, code free, and user driven. This means business users acting as “citizen developers” can configure the platform to perform analytics and create insights at the pace of business. When all your professionals have the access to configure what they need, the value to a company grows exponentially.

This capability demanded another significant change in how we deploy and support GIS technology here at BP. We have truly opened the platform to our entire company. As we began the rollout, we gave business users a basic orientation on how to configure and create apps and then said, “Here’s the playground. Do what you need to do to solve your business problems.”

They responded eagerly. We are seeing hundreds of maps, apps, and dashboards emerge across our platform, many of which would only have been possible—under the prior way of working—after a user manually retrieved and reviewed various paper and/or digital projects and maps.

This is a powerful example of how our users are configuring location intelligence apps to make better decisions. When that is scaled across tens of thousands of employees, the results are a diversity of ideas, an informed focus on integrated business workflows, gains in productivity, reduced risk, and business agility.

The One Map platform facilitates this on a daily basis. And yet there is a lesson lurking on the flip side of that revelation: Once business users begin creating their own apps, the support team must keep up with them, not vice versa. Mindful that users can quickly lose trust in software platforms that don’t support their needs, we needed to make another significant change in our approach, and this leads to the next lesson: Supporting an enterprise platform.

Lesson 5: System and user support in this new paradigm

Typically, when a company deploys a software solution, the deployment team relies on an install manual and a standard database and format. The setup usually includes a support desk for users, with a few scripts to follow for common workflows. In the worst-case scenario, a vendor support desk might be needed to help with a software issue or tough workflow definition.

In the case of a geospatial platform, there is none of that. Instead, there are different levels of technology, various platforms to deploy on, a massive and diverse set of unknown workflows, and numerous data formats to oversee. Different versions of information emerge over time, and each version can be perfectly valid, depending on the use case.

The team that supports an enterprise platform with all these challenges across a global enterprise needs to be as knowledgeable as its user community. That means understanding the technology, the application use cases, data formats and workflows, analytics and displays, and even basic cartography.

Close collaboration between the IT and business organizations helps create the support structure that is critical to achieving enterprise platform success and sustainable results.

Lesson 6: Automation

I cannot stress enough the role that automation plays in a successful geospatial platform deployment. In all my years of working in this field, I have never heard an internal customer say, “Thank you, that’s all I needed.” Everything we touch tends to grow and evolve quickly or spawn a similar effort—all of which leads to more work for the team. This is a great indicator that the team is adding value and the platform is having a positive impact. But without good management, the team can consume all its available resources on new ideas, leaving the core platform to suffer.

To counter that, the BP team created a golden rule early on: If there’s a chance that a workflow will be needed again, automate it the first time. Automation helps on many levels. It ensures consistency and facilitates continuous improvements. It allows more transparent tracking and reporting of process status. Most importantly, it allows a company to run many more processes than could ever be achieved with hands on keyboards. We now run hundreds of automations around the company, with some firing every few seconds and others only a few times a year.

The lesson we learned was to invest as much thought in the automation platform as in the GIS technology itself.

Lesson 7: Marketing matters

When a company deploys an enterprise platform to tens of thousands of employees—whether it’s GIS, ERP, or another technology—branding, marketing, and communications matter. Here are several marketing lessons we learned during our digital transformation:

- Build an identity: To get traction on the big initiatives, create a program brand that users can identify with. We dubbed our GIS platform One Map, which highlighted the theme of a single mapping infrastructure for all of our location intelligence. We then promoted the program identity, rather than the GIS technology behind it.

- Mind your language: At BP, as at any company, executives and professionals tend to think about GIS or ERP as they think about PowerPoint or Word. In other words, applications aren’t particularly important to them; business results are. So, when we began our enterprise platform rollout, we avoided the term GIS in promotional materials. Instead, we spoke to users in language that resonated with them. When we talked to the IT people, we described systems of record, systems of insights, and platforms. When we talked to the business people, we stressed production optimization, safety and efficiency, access to information, advanced analytics and dashboards, and overall quicker time to decisions.

- Communicate: Our One Map launch campaign deployed emails, posters, and flyers in every BP office around the world, as well as advertisements on office televisions, to convey the business benefits of One Map and get BP professionals excited to leverage it. We also created three levels of internal websites. A high-level website conveyed a generic message about location management and analytics and how those tools are used in our company. Another site, titled Community of Practice, was tailored to our technical-savvy data and information professionals. Lastly, a tools dashboard allowed users to dive into specific tools, data models, and workflows in support of specific work. Communication is ongoing and includes regular Yammer posts, news stories, and internal articles. The learning here is to ensure that there is a budget for communication, resources assigned to it, a plan for ongoing engagement, and a concerted effort to end every communication with a call to action.

Lesson 8: Measure success

It can be difficult to measure the impact of something as vast as a location intelligence platform for more than 70,000 employees spread across the world, but it is important to ensure ongoing internal support. One simple way to gauge success is to monitor how many employees become active users of the platform and its apps. At BP, more than 7,000 users signed up to use the GIS platform before we launched our communications campaign, strictly through social channels and other digital sharing. Now, just four months since launch, more than 10,000 users have accessed the system.

Given the diversity of use and the size of the global community, we are now taking our tracking and reporting to new levels of detail, including tracking users, datasets, services, maps, apps, and more on a daily level. These metrics help ensure that we can communicate the impact of the platform, but they also assist in our support of the system. With these details, we can drive better hardware and software decisions, understand which datasets are used more or less than others, as well as see when a technical community is more active in one region than another, signalling that we may need to organize targeted knowledge-share sessions.

Another key way to measure success is by efficiencies gained. If someone at BP can access the data they need without having to load it manually, and users can quickly configure the functionality needed to analyse it, and then decide how to communicate it through maps, apps, or dashboards, we might improve that person’s annual efficiency by 3–5 percent. For a technical worker who needs location intelligence more often, it might be 5–8 percent. Since these gains come from a shared enterprise platform where an app or dashboard can be leveraged in similar workflows, the percentage gain is almost assuredly higher.

When executives add up these productivity gains, factor in the average resource salary and the number of people leveraging the system, and follow progress over time, they can begin to put a number on what a company gains from approaching location intelligence with a geospatial platform over bespoke solutions.

By going to an enterprise platform, sharing information within geographies and across divisions, we have greatly reduced startup time for new analytics projects. Now, more data is available on a platform that's faster to access and use, and, therefore, people can find better insight and drive better decisions.

Brian Boulmay, BP

Our next steps

Digital transformation, whether via GIS, ERP, or another enterprise system, is not the destination. It’s the means to solving business problems by leveraging digital systems and integrated workflows. Given the nature of digital systems, organizations must engage in an ever-evolving effort to update, maintain, and deliver needed capabilities.

Our initial deployments were predominately internally hosted systems, but as we begin to envision the next generation of our platform architecture, we want to move more infrastructure onto the cloud, so our users can access GIS-driven data and apps on any device, anytime, anywhere.

As we have watched the technology evolve, we have also seen the industry’s application of location intelligence change. We believe the number of use cases for location data, analytics, and visualization is about to explode in several areas of our business.

Augmented reality (AR) and virtual reality (VR) techniques are beginning to merge with BP’s traditional location-based systems. We are placing sensors on many assets, stationary and mobile, and linking them to real-time Internet of Things (IoT) frameworks. Our building information systems are also beginning to link with real-world geography.

Imagine the efficiency gains we could achieve if an oil field technician could view real-time conditions, whether on a laptop, a tablet, Google Glass, or even an AR/VR display, in the office or the field. In this real-time display, they could view equipment maintenance history, health status, operating parameters, user manuals, or even click a button to kick off a replacement activity—which would integrate with the planning process and send an equipment order to the procurement system. To achieve this, the user needs to be able to track location in the real world, inside the fence line, inside the building, and back again. This will require a level of geospatial awareness, capability, and integration we have not yet seen in our industry.

Many executives might read this and think, “It must have been easy for BP because they had millions of dollars and hundreds of people working on this location intelligence platform.” In reality, we had a very small budget and only five people working to start the platform. We delivered to scale by rethinking some of our traditional approaches to geospatial capabilities. We focused on platform over solution and worked to enable a larger community of users across the business who could drive BP’s data, analytics, and apps forward.

For companies working to achieve sustainable digital transformation in the geospatial domain, the enterprise platform approach is worth exploration. Here at BP, we’ve found that it’s an effective way to distribute the technology throughout the company and multiply its benefits exponentially across our business.

hello: there

Business Advantage through Location Intelligence: The CEO’s Guide

The CEO oversees a company's strategy and operations. This guide reveals how location intelligence benefits those in the corner office.

Editor’s note: This article is the first in a WhereNext series dedicated to CXOs. Location intelligence is a brand of business intelligence that helps executives understand customers and business trends in locations around the globe. Throughout this article, we’ll explain how a CEO can turn location intelligence into business advantage.

A chief executive officer establishes goals for the company and defines a vision for its future. Being responsible for success in a shifting, competitive environment can leave CEOs searching for new tools. One increasingly relevant tool is what Forrester principal analyst James McCormick calls an analytics-driven strategy.

Business leaders “need to embrace insights at scale,” McCormick said on a recent podcast. “We need to have data and analytics technologies that deliver strategic value, not just the typical ROI kind of value. And that value needs to differentiate us. So we need to understand our businesses, our customer, our processes in such a way that it delivers this differentiation.”

Location intelligence can be key to helping a CEO define that differentiation. Location intelligence comes from analysing business data in a geographic context—for instance, the location of sales, the online spending habits of consumers in cities around the world, or regulations and events that affect supply chain decisions.

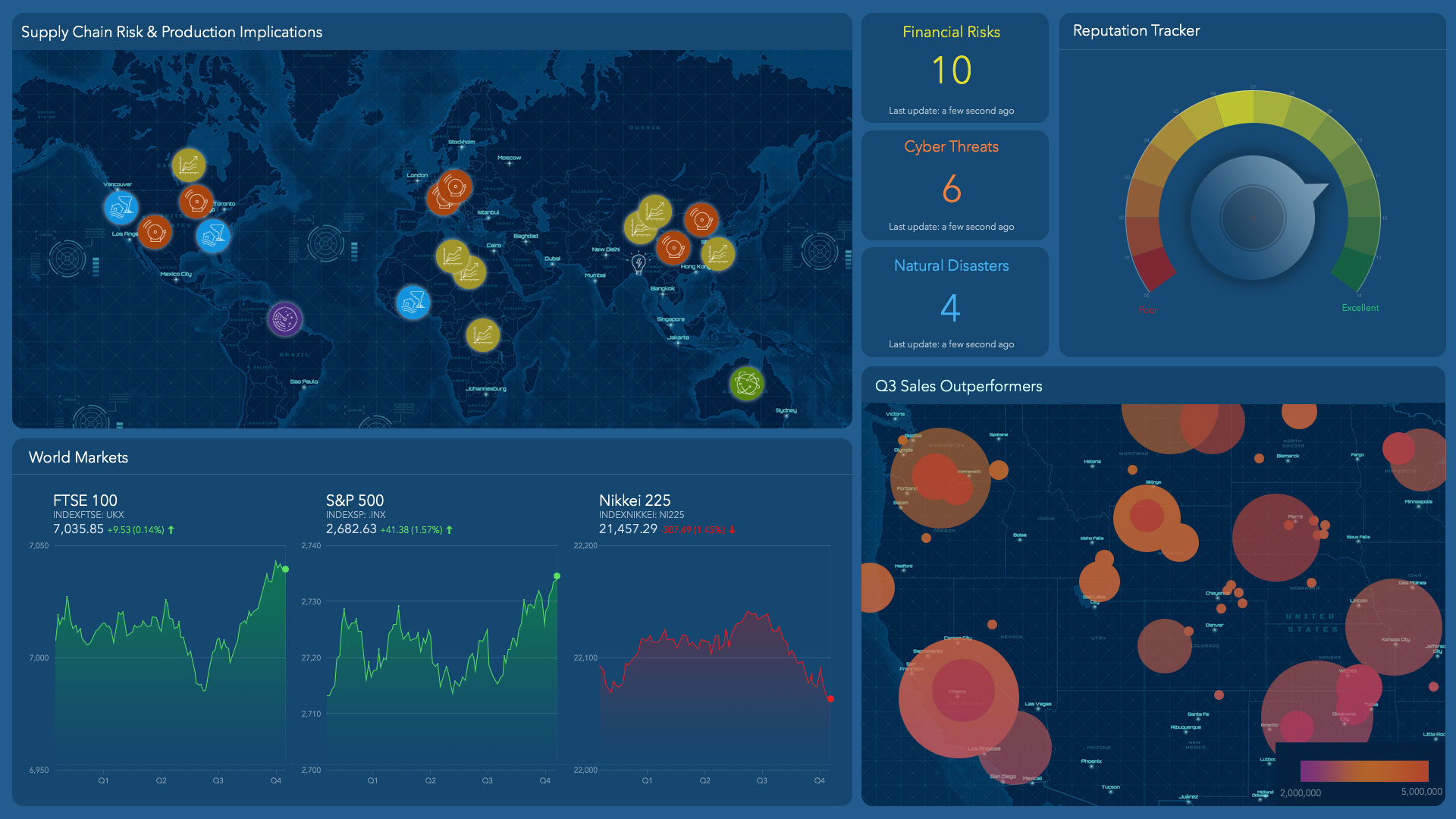

In short, location intelligence brings clarity to local, national, and global trends. A location intelligence strategy supports many of the CEO’s major responsibilities, including recognising and adjusting to patterns in sales, service, and efficiency across corporate locations, as well as anticipating global market movements and demographic shifts. The engine behind location intelligence is a geographic information system (GIS)—technology that analyses and organises information on smart maps and dashboards.

A CEO can monitor the patterns revealed by location intelligence on a GIS dashboard that updates sales trends, customer characteristics, population demographics, supply chain costs and efficiency, and the company’s reputation.

“Peter Drucker, the internationally renowned management consultant, once said the purpose of a business is to create and keep a customer,” says Thomas Horan, dean of the School of Business at the University of Redlands in California. “To serve those customers well, CEOs must have both a strategic as well as a tactical understanding of where the business is in the marketplace and how it is performing.”

In this opening article in WhereNext‘s series on location intelligence for the C-Suite, we explore how location intelligence can support the major responsibilities of a CEO, drawn from real-world situations and case studies.

Monitor and Respond to Business, Economic, and Societal Trends

By analysing millions of data points that affect production, sales, or transportation—from shifting workforce demographics to changing markets and weather patterns—GIS technology distills big data into CEO-level insight. Smart maps provide real-time status reports on trends and conditions that are important to improving current business and planning long-term strategies.

In the manufacturing sector, the trend of declining car ownership provides a useful study in how a CEO might apply location intelligence. Navigating a trend of such significance—with its threat to business models and its board-level visibility—demands reliable intelligence and a well-tuned strategy. A CEO can map out insight from global markets and submarkets to understand how, where, and at what pace consumer preferences for automobiles are changing. With that intel, a business leader can adjust the business model to outpace competition.

Across industries, GIS empowers analysis and action through executive-level dashboards that monitor:

- Trends and risks in locations around the world, providing situational awareness of current and potential markets

- Risk factors or opportunities related to changes in political, cultural, or economic patterns

- Market indicators, including fluctuations in monetary systems, regional or local economies, stock markets, and interest rates in regions around the world

- Social media trending topics that reveal consumers’ concerns about the economy, business, or society

Location intelligence guides competitive decisions by illuminating an area's demographics, including age, gender, education, income, and even nuanced data such as entertainment preferences.

Develop and Sustain a Deep Understanding of the Customer

CEOs must comprehend changing customer expectations and respond with new or modified products and services.

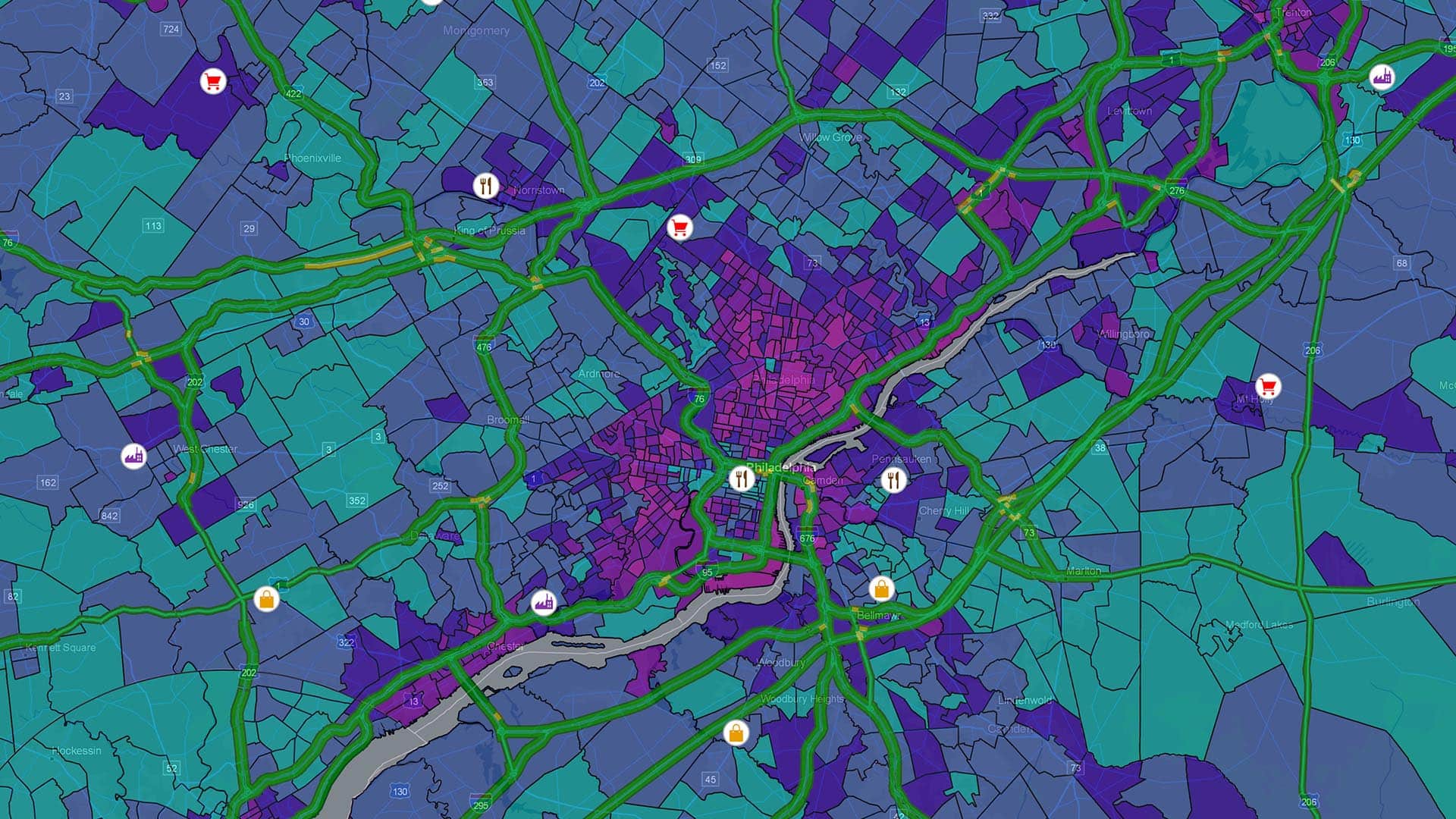

For the founder and president of a large furniture retailer in the Midwest, the early days were driven largely by intuition. But as the business grew—today it ranks among the category’s top retailers in the country—the scale and size of its investments demanded greater rigor. That’s when the CEO turned to GIS-driven location intelligence to understand who and where the company’s customers were.

With GIS data that gave him a deep understanding of not just who his best prospects were, but where they were, the young chief executive piloted an expansion that continues to this day. “Having some additional data to fine-tune [my] instinct was very, very beneficial,” he says.

Likewise, when executives at one of the nation’s largest fast-casual restaurants sought to roll out an app that would allow customers to order food on their phones, location intelligence played a key role. For the pilot phase, the company could have simply chosen markets where sales were highest. But the executives dug deeper. Using GIS-powered analytics, they mapped out the cities that showed strong sales and high digital adoption rates. The analysis—which revealed what percentage of people in each city had recently used their phone to make a product purchase—fostered a richer understanding of customers than most executives enjoy. With that insight, the company adopted a data-driven strategy for rolling out its new service, maximising adoption and minimising wasted marketing spend.

Grow the Business and Fend Off Competitive Threats

“A senior executive’s job is to look outbound at the market and pay attention to the competitive stance of the company and its future as a viable entity,” reports Brian Kilcourse, managing partner of RSR Research, in an upcoming podcast.

How Location Intelligence Supports the Roles of the CEO

To establish business goals and set a vision for the company’s future, CEOs must:

- Monitor and Respond to Business, Economic, Societal and Global Trends—GIS can receive real-time metrics and immediately analyse them in terms of corporate strategy, then map them for leadership review.

- Develop and Sustain a Deep Understanding of the Customer—Location intelligence can track and analyse demographic changes, personal interests, and sales for any geographic size.

- Grow the Business and Fend Off Competitive Threats—Get electronic maps of expected population growth, sales, and competitor expansions.

- Decide How and Where to Allocate Resources—Support decisions with knowledge of where likely customers are located and the cost of supply chains that provide products and services.

- Develop and Promote the Best People and Practices—Show the stats and distribution of winning strategies to reinforce success and to underscore which locations need help.

- Ensure that the Workforce Reflects the Diversity of Customer Base—To keep current, make sure your employees represent all the changing demographics and tastes of your customers.

- Protect and Strengthen the Company’s Reputation in the Marketplace—Maintain real-time analysis of social media and public perception of your company to intercede quickly when and where problems arrive with any product or service.

The tricky thing about competition is that it changes. In the utilities industry, for instance, competition was practically non-existent before deregulation efforts in the 1990s. After the dust of that upheaval settled and utility CEOs had recalibrated their market strategies, the ground started shifting again. This time, democratization is the culprit, as individual homeowners, residential collectives, and businesses generate their own power through solar and wind sources. Forward-looking utility CEOs are using location intelligence to understand where that competitive threat exists as well as to plan how to get ahead of it.

In retail, manufacturing, and other industries, intelligent mapping gives business leaders a sense of how specific areas are changing—whether residents or visitors are beginning to skew to an older demographic, display different lifestyle choices, or favour competitor brands. A CEO’s dashboard can track location-based insight such as planned competitor locations and markets where rivals are reshaping product lines.

Some chief executives take a more direct approach, enlisting services that use artificial intelligence (AI) to interpret satellite images and reveal trends among competitors. Others fly drones over rivals’ facilities or fields to understand production levels and techniques. (To learn more about business applications of AI, read this e-book.)

All this data, at local and national levels, feeds into executive decisions about how to allocate corporate resources to expand and develop offerings.

Determine How and Where to Allocate Resources

One large retail chain used location intelligence from GIS to analyse its supply chain and cut its number of service centres by more than half, creating major improvements in customer experience and profitability.

“At one time, the company had almost 50 service depots across the US,” explains Avijit Sarkar, a business professor at the University of Redlands. “They were sending out delivery technicians to service their products at millions of households in an almost haphazard way, because they had not managed this part of the business well.”

With the bottom line suffering from those inefficiencies, the CEO and executive team enlisted GIS—which they had long used to support market development—to help optimize the service and delivery supply chain. They mapped out the locations of customers, technicians, and supplies, and analysed metrics such as:

- Customer delivery and service routes, including time-sensitive deliveries

- Fuel and maintenance costs

- Accident reports and costs per route

- Driver and service personnel salaries and benefits

- Regions of anticipated customer growth

The resultant maps revealed efficiencies that human planners couldn’t possibly have calculated at a national scale. The executive team reduced the number of service depots to 22 from 46, Sarkar says. “Imagine the effect of that. You are servicing the exact same geographies spread all across the US with half the number of offices [and] a significant reduction in truck drivers and fuel costs.”

When CEOs analyse opportunities for business expansion, location intelligence gives them confidence that a new market will support the company's product or service.

Develop and Promote the Best People and Best Practices

In a bustling economy, talent acquisition and retention are CEO-level concerns. To perform reliable long-range workforce planning, a CEO must be alert to hard and soft data about where talent is moving and emerging, and how the company might harness it.

Location intelligence plays a substantial role in that effort. A CEO might map out quantitative data, such as the results from a recent study documenting the migration of millennial professionals to big cities. But just as important is location intelligence drawn from softer data, some of which can signal emerging trends.

James Fallows, longtime contributor to The Atlantic and a former presidential speechwriter, recently published a book highlighting small cities that are driving innovation in America. Reflecting on his travels to those cities, Fallows told WhereNextthat executives should consider seeking talent in unexpected places. As evidence, James cited “a wave of young, technically savvy people wanting to live in, be part of, and help create a real place. Not just to be one more person in the Bay Area scrum, but to be helping to build Fresno or Spokane or Duluth or Greenville or any of these other places.”

Business leaders can use GIS technology to spot those demographic shifts before competitors do.

Location intelligence also helps CEOs pinpoint notable talent and practices within a company. A C-level dashboard might display the locations of the highest rated peer-reviewed employees in a global company, and spotlight product development groups that contribute the most to revenue.

With that location intelligence, an insights-driven CEO can ensure that best practices are captured and continually refinedand that high performers are encouraged, promoted, and retained.

Ensure that the Company Workforce and Culture Reflect the Diversity of the Customer Base

Today’s forward-looking CEO aims to create a workforce that reflects the demographics of the markets the company serves. In this pursuit, productivity is as much a driver as principle. A 2013 study highlighted in the Harvard Business Review found that companies with diverse workforces are 45 percent more likely to report that their market share expanded year over year.